Online Sales – Reality Check

There is a lot of hype around e-commerce, the heralding of the digital era and so-called apocalyptic end of the brick-and-mortar stores. Let us scratch beneath the surface and look at the stats.

In 2013, online retail sales totaled $263 billion, which accounts for 6% of the total retail sales. The growth rate of online sales was 17% – against that of a mere 3.5% for in- store sales. The future also looks pretty solid for the e-tailers with the U.S online retail sales expected to grow by an impressive 57% to $414 billion at a compounded annual growth rate of 9.5% by 2018.

Clearly, while e-tail is relatively small, it seems to be growing at a frenetic pace. But, are we looking at the complete picture? Is the multi-billion dollar industry that simple to decipher?

Asymmetric Comparison

The brick-and-mortar sales added to $4.3 trillion in 2013, with 87% of the shoppers purchasing from physical stores (instead of online). This 3.5% in-store sales growth looks pretty small against the growth of online business, but in value terms it amounts to $144 billion. This number is quite comparable with the total market size of online businesses. Needless to say, the relatively small “base” of online sales, allows them to grow at higher pace.

Thus, the current picture is not as grim for the retailers as the naysayers may believe. And the complexity of choosing the right metric for comparison adds a halo around the e-tailer business.

Now the real questions that need to be answered are, where exactly is the industry heading to? How will the future playfield look like? Will the animosity between these two models of business continue, or will they complement each other like husband and wife, both being equally important?

Digital goes Physical, and vice versa

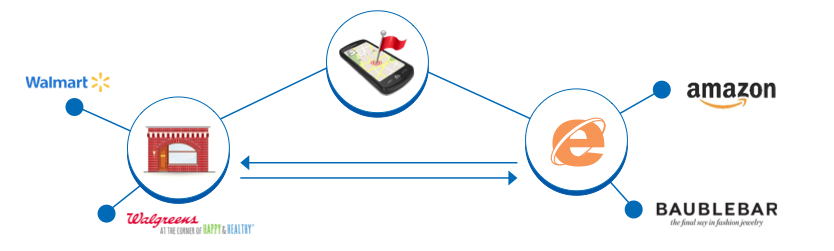

In the words of Forester analyst Sucharita Mulpuru , “Amazon is in an environment where retailers are catching up”. According to Craig Johnson, President of research firm Customer Growth partners, “Bricks and Click store based retailers have stepped up and companies like Amazon are facing a higher competitive bar, in terms of online sales”. Wal-Mart has increased its budget of online sales from $1 Billion to $1.2-1.5 billion for the next year. The online sales growth of Wal-Mart too surpassed the growth rate of Amazon sales, for one of the quarters of 2013. Fashion stores like Nine West based in Los Angeles have given directions to its in-store salesman, to showcase its existing range (which might be currently out of stock) and also the upcoming range to its customers using an iPad. The orders are booked and delivered based on the ETA promised to the customer. Location based advertising on Smartphone is also proving to be a disruptive form of marketing, which is enhancing boundaries and increasing the customer reach. Retail giants like Walmart, Target and Macy’s have developed ‘Apps’ which allow users to look for product availability in the ‘local stores’. Additionally, Walgreens has teamed up with Foursquare, a location based social networking site, to offer electronic coupons to the customers on their phone when they enter a Wallgreen store.

All these have proved to be a trigger for the online retailers to rethink their strategy; many online retailers are investing in brick-and-mortar stores to engage the customers. Amazon.com recently announced its plans to open up a store in the middle of New York City. This store will be located at Herald Square, right next to Macy’s department store and near the Empire State building, marking a big shift in the marketing strategy of the e-tailing pioneer and behemoth. Likewise, more and more online retailers such as BaubleBar (jewelry), Birchbox, etc. are opening up brick-and-mortar stores, to give the customers a “feel” of their product range

Omni-Channel Strategy

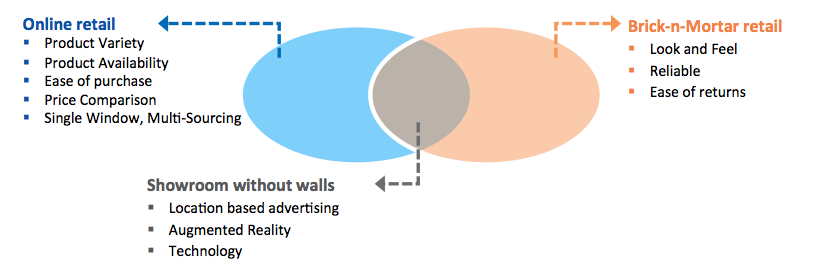

This new strategy of complementing each other is referred to as ‘Omnichannel’ strategy – giving a standard, integrated shopping experience to the customer. With the recent developments in technology and augmented reality, the gaps between traditional and internet marketing are filling really quickly, enabling retailers to interact with customers through multisensory mediums and exposing them to a rich blend of off-line sensory/touch-feel information and online content. This combination of physical, virtual and location based advertising will transform the world into a ‘Showroom without walls’ and a concierge model will evolve with focus towards engaging customers rather than focusing only on transactions and delivery. The new form of marketing will affect not only the customers, but also the players both upstream and downstream in the retail chain. Customization of products will be the need of the hour, requiring the suppliers to tie up with the retailers. The manufacturers in order to meet the demands will have to function with a quick turnaround time, thereby prompting them to be more agile and innovative. Increased usage of technology both by customers and retailers will lead to data collection at every step of this newly evolved retail chain. The ‘Long term winner’ will be the one whose decisions are data driven and analytics oriented. The future retail poses a lot of challenges for the current retailers, but also opens up a lot of opportunities for the retailers who are willing to use information and technology to leverage analytics driven decisions.

Sources and References:Techcrunch, Internet Retailer,Business Insider, Forbes, CNBC, ICSC, etc.

Other reading material :